Our five thematic investing rules

To paraphrase famous physicist Richard Feynman’s quote on quantum mechanics: the feeling of having finally grasped thematic investing indicates that one hasn’t understood thematic investing at all.

Simplistic approaches to the segment inevitably lead to disappointment, but investors who approach it strategically, yet with an adaptive mindset and an active trading mentality, are more likely to reap the benefits.

Upheaval due to Millennials and Generation Z

New investment themes are taking centre stage as millennials and Gen Z emerge as serious consumers. Those born in the mid-sixties and later are shifting their spending online. They increasingly work from home (accelerated by the Covid-19 pandemic), date responsibly (Bumble), order healthy food for themselves and their pets (DoorDash and Chewy, respectively), explore new technologies providing significant health benefits (Celsius), and boost income by renting out spare rooms (Airbnb).

This is creating an afterburner effect on an already hot equity market. However, recent inflationary scares against the backdrop of hawkish central bank gestures, and the prospect of higher yields, indicate the party for thematic and high-growth investments might turn sour.

View to China

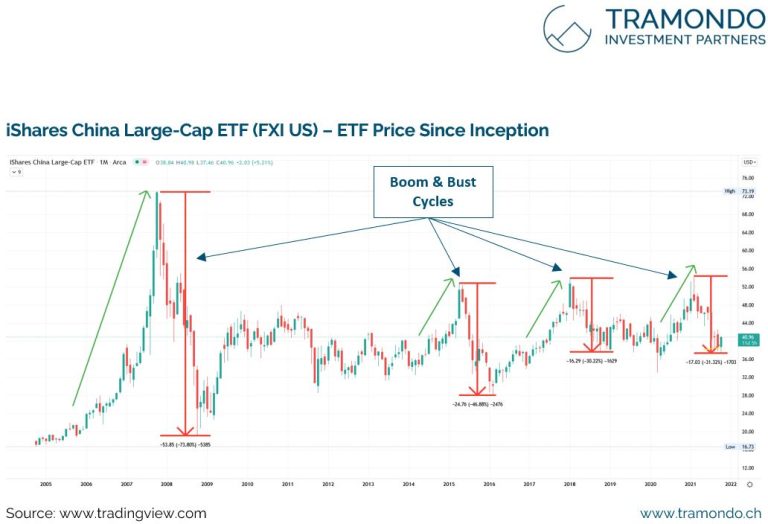

So, it pays to closely watch the Chinese equity market, where high-flying thematic investments have already gone through several boom and bust cycles (Chart 1).

To advocate for a rebalancing away from active thematic investments into passive ETFs, which remain in high demand, could create the ultimate false sense of security.

Looking more closely, few pure-play ETFs provide the expected broad equity market beta exposure. Contrary to their label, many contain flavor-of-the-day investments such as Apple or Tesla.

Instead, when talking to investors, we encourage them to adopt a few cardinal rules of thematic investing that have served us well.

A fistful of rules

Rule one is to diversify not only across stocks but also across a theme’s value chain. Taking e-sports as an example, one could look at Nvidia (graphics cards), Logitech (accessories), Activision Blizzard (games), and Sony (consoles).

Rule two is to strive for a marathon mindset. An excellent thematic opportunity, fundamentally a ‘good story’ in our internal speak, tends to be supported by a secular trend lasting up to 10 years or more.

Every trend eventually suffers a setback, however. This is why investors should consider rule three, which is not to attribute performance during an upward trend to investment skill instinctively.

We prefer to actively trade around a trend (‘good chart’), exiting technically overbought positions and scaling back in after a healthy correction. We just did that with our Asian exposure, where we took profits without losing belief in the underlying fundamental good story.

The fourth cardinal rule is to construct portfolios with high-quality constituents.

They tend to be, primarily, founder-led, high-growth companies with large addressable markets. Investors should look for dominant businesses with a defensible market position that allows them to compound their revenues, cash flows, and earnings for an extended time.

Revisiting Feynman’s quote, we do not claim to have figured out thematic investing. When talking to investors, we employ a sailing analogy.

While one cannot possibly control the winds, one can set the sails accordingly and benefit from both headwinds and tailwinds. This brings us to the fifth and final cardinal rule, which is to remain humble.

Nobody in investing is infallible. We own up to our mistakes and emotionlessly cut any position that stops conforming to our ‘good story/good chart’ criteria.